This tax is valid on personal tax returns only. The tax return must be filed between January 5 through February 28, 2018, at the participating offices to be eligible. The type of federal tax return you file is determined by your tax situation as well as IRS rules. Additional charges apply to Earned Income Credit as well as additional forms for local and state tax returns, and when you opt for other products and services. Go to hrblock.com/ez to locate the closest office participating in the program or to make an appointment. OBTP#B13696 (c)2017 HRB Tax Group, Inc. Visithrblock.com/ezto find the nearest participating office or make an appointment.

Password 123

HRBlock Deluxe Efile State

Get together in an office or chat on the phone or via video. Bring your documents and let the tax expert complete the work. Simply review and accept your tax return. (c)2015 InComm. All Rights Reserved. Vanilla Reload is offered through ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transferrer by the New York State Department of Financial Services.

You can file with confidence that you won’t find it anywhere else. Emerald Card The best in electronic banking, using a prepaid debit card.

It doesn’t provide the payment of any tax or penalties that taxing authorities impose and is not a legal representation. Additional conditions and restrictions apply. See the Free In-person Audit Support page for full information. Additional restrictions and terms apply. Check out Free In-person Audit Support for all information. Additional conditions and restrictions apply. Check out Free In-person Audit Support for full details. IRS Income Tax Course 160. The enrollment in, or the successfully completing, the Income Tax Course is not an offer or any guarantee of employment. Other qualifications could be required.

We’ve got the tax forms, instruments, and support that investors and charitable donors need to go from tax-free to excellent. US Mastercard Zero Liability is not applicable to commercial accounts.

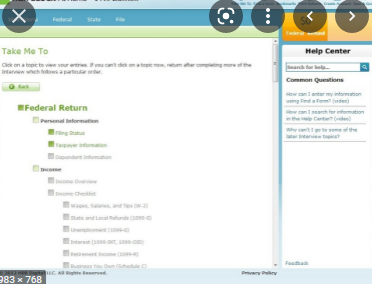

HRBlock Deluxe Efile State Features

State e-files are available in the program. A fee is added online. State e-files are unavailable in NH. Additional state programs are available. The majority of state programs are offered in January.

Get a tax professional to file your tax return in a professional office, home and we’ll handle the job. Filing through H&R Block and you’ll see your refund information in real-time. You’ll always know what you can be expecting from H&R Block. Our Tax Institute Our experts share information on the most recent tax-related topics.

Get advice on legal issues. H&R Block prices are ultimately set when the print or electronic file. Certain limitations apply.

If you want to complete your state tax return, first, you need to buy and install the appropriate federal edition. Starting price for simple federal return. Prices vary based on how complex.

How to get HRBlock Deluxe Efile State Free

We were unable to locate the office according to the search criteria you have entered. You should modify your search. To see a complete list of Emerald Card charges, please refer to the Cardholder Agreement. You may need to install, or even reinstall the H&R Block state software following the time you purchase it.

Absolutely! You can electronically file three state returns with an individual filer.

Access to funds faster is based on the comparison of traditional bank policies for check deposits and electronic deposits. Enrolled agents do not offer legal representation. Signed Power of Attorney required. Audit services are tax-related advice only.

HRBlock Deluxe Efile State System Requirements

- Memory (RAM): 512MB of RAM required.

- Operating System: Windows XP/Vista/7/8/8.1

- Processor: Intel Pentium 4 or later.

- Hard Disk Space: 500MB of free space required.